We have interviewed many Ontario personal injury lawyers over the years, and there is a strong sense that auto insurance companies are increasingly likely to fight plaintiff claims. In earlier articles, we reported several factors driving this perception, including:

- Ontario legislative changes over the years allowed insurers to “bully” plaintiffs

- Adjusters used to be independent but now tend to work for the insurers

- “Americanization” of insurance companies’ tactics

- Defence lawyers insisting on discoveries and/or not attending pre-trial

- Increased use of Experts, reaching different conclusions from the same facts.

We have assembled official data that indicate some auto insurers are indeed more litigious.

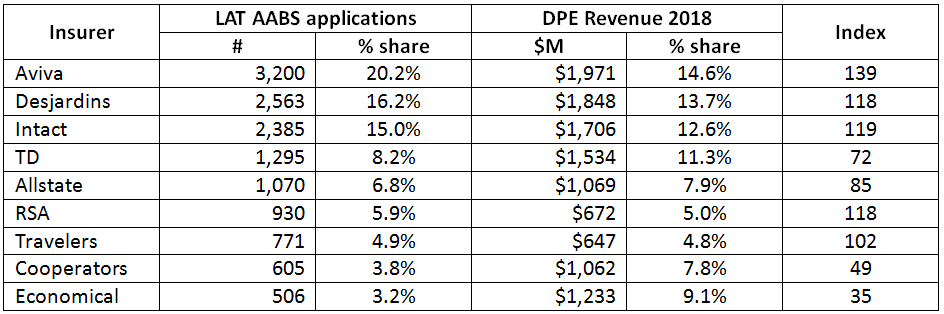

Duncan Macgillivray, a personal injury lawyer in Thunder Bay, accessed Licence Appeal Tribunal (“LAT”) data on behalf of FAIR Association of Victims for Accident Insurance Reform. This lists Automobile Accident Benefits Service (“AABS”) applications by insurer name from February 2018 to early March of 2019.

We accessed the Lazar Report, written in December 2019 by Dr. Fred Lazar of York University for the Ontario Trial Lawyers Association. This report shows insurers’ Direct Premiums Earned (“DPE”) in 2018.

We focused on the nine largest auto insurance groups in Ontario, each with more than $500 million in 2018 DPE, who collectively accounted for 87% of all industry revenues in 2018.

One might expect the biggest insurance companies to be involved in the largest numbers of LAT AABS applications, and this is indeed the case: these nine insurance groups accounted for 84% of all such applications.

Comparing each company’s revenue to its number of LAT AABS applications shows us that some are in disputes even more than their relative size would indicate.

EXAMPLE: Aviva had 20.2% of all LAT AABS applications, but 14.6% of all auto insurance industry revenues. The Index of 139 means Aviva has 39% more applications than might be expected.

Our “Litigious Index” produces this ranking of insurers most likely to be involved in LAT AABS applications:

- Aviva

- Intact

- Desjardins

- RSA

- Travelers

Wawanesa also appears to be involved in more than its expected share of applications, with 672 (more than either Cooperators or Economical, which are both bigger companies). Wawanesa is not a Top 10 insurer (so has market share of around 3% or less) but is involved in more than 4% of LAT AABS applications, which would place it on par with Aviva in our “Litigious Index”.