The Financial Services Regulatory Authority of Ontario (FSRA) regulates the billing and business practices of licensed Service Providers (SPs) who receive direct payment from auto insurers under the Statutory Accident Benefits Schedule (SABS) through the Health Claims for Auto Insurance (HCAI) billing system. SPs include clinics providing medical and rehabilitation services, and assessments and examinations providers. All SPs must submit requests and billing for goods and services via HCAI, but only those licensed with FSRA can receive payments directly from insurers. (Insurance companies pay the claimants who receive treatments from unlicensed SPs, and the claimants reimburse the SPs for services.)Licensed SPs should understand and must comply with the standards of practice prescribed in O. Reg. 90/14 under the Insurance Act.In September 2022, FSRA published its latest annual market conduct compliance report. FSRA executive vice president Huston Loke told Insurance Business magazine: “FSRA is taking action because a small number of health service providers have failed to respond to our industry eblasts, multiple reminders, overdue notices and personal phone calls encouraging them to file their Annual Information Returns on time.”FSRA uses a risk-based approach when selecting licensees to examine. This approach uses indicators such as complaint data, licensing information, Annual Information Return (AIR) data, the Health Claims Database, and lists of sanctioned practitioners from regulatory colleges governing regulated health professionals (RHPs).One focus was on clinics providing virtual care during the COVID-19 pandemic. This covered licensed SPs who met one of the following criteria:

- Attested to conducting virtual care appointments during 2020

- Billed at least $30,000 through HCAI in 2020

- Overall billing increased during the pandemic (from 2019 to 2020)

The most common non-compliance areas identified by FSRA:

- OCF-21 invoices not signed. Invoices must include the authorized signature of the RHP, or the ‘Authorized Signatory’ designated by the RHP.

- SP policies and procedures not established or sufficient relative to the nature and volume of their SABS-related business. Policies and procedures must be designed to avoid submission of false or misleading information to an insurer, and to prevent the business from facilitating such activities by others. Policies and procedures should be communicated to all staff and providers involved in SABS billings to avoid facilitating or conducting non-compliant practices.

- HCAI roster outdated/inaccurate

- Incorrect calculation of SABS claimants.

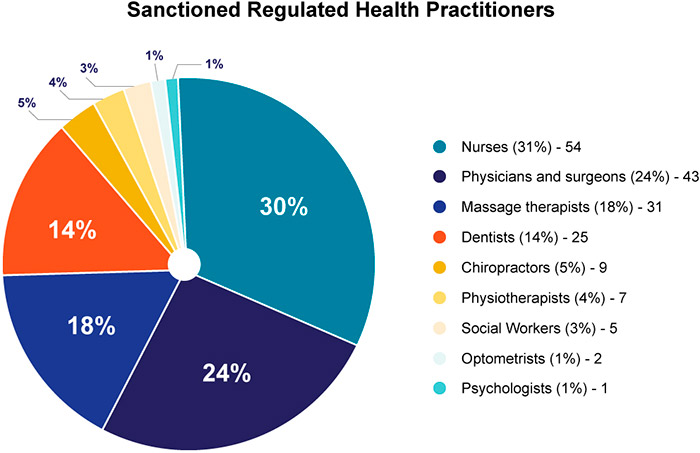

In April, FSRA revoked 169 SP licences, and suspended 59 more, for not filing the AIR and paying the annual regulatory fee for one or more years. In September, FSRA suspended the licences of 106 SPs who failed to file their AIR between 2018 and-2021.These businesses are not allowed to receive payment directly from auto insurers for SABS claims.FSRA also identified 177 individual sanctions against RHPs by their regulatory colleges. Of these, 27 appeared on the HCAI roster of 90 licensed SPs, although no licensed SPs billed via HCAI using the credentials of a sanctioned RHP. Nurses and medical doctors comprise most sanctioned practitioners.

Personal injury lawyers rely heavily on medical expertise to build their cases. To ensure the bona fides of such experts, the College of Physicians and Surgeons of Ontario maintains lists of doctors that show their status and any disciplinary proceedings. Details of the college’s Discipline Tribunal also appear on the Canadian Legal Information Institute (CanLII) website.You can find the full list of physicians and surgeons here, searchable by last name.You can find the list of upcoming Discipline Tribunal hearings and recent decisions here.You can find the list of recent SP suspensions here.You can find the full public registry of licensed and formerly licensed SPs here.